Some Known Details About Insurance

Wiki Article

The Best Guide To Insurance Ads

Table of ContentsThe Single Strategy To Use For Insurance Quotes3 Simple Techniques For Insurance CommissionSome Of Insurance Agent Job DescriptionInsurance Quotes Can Be Fun For EveryoneInsurance Quotes Fundamentals ExplainedAn Unbiased View of Insurance Account

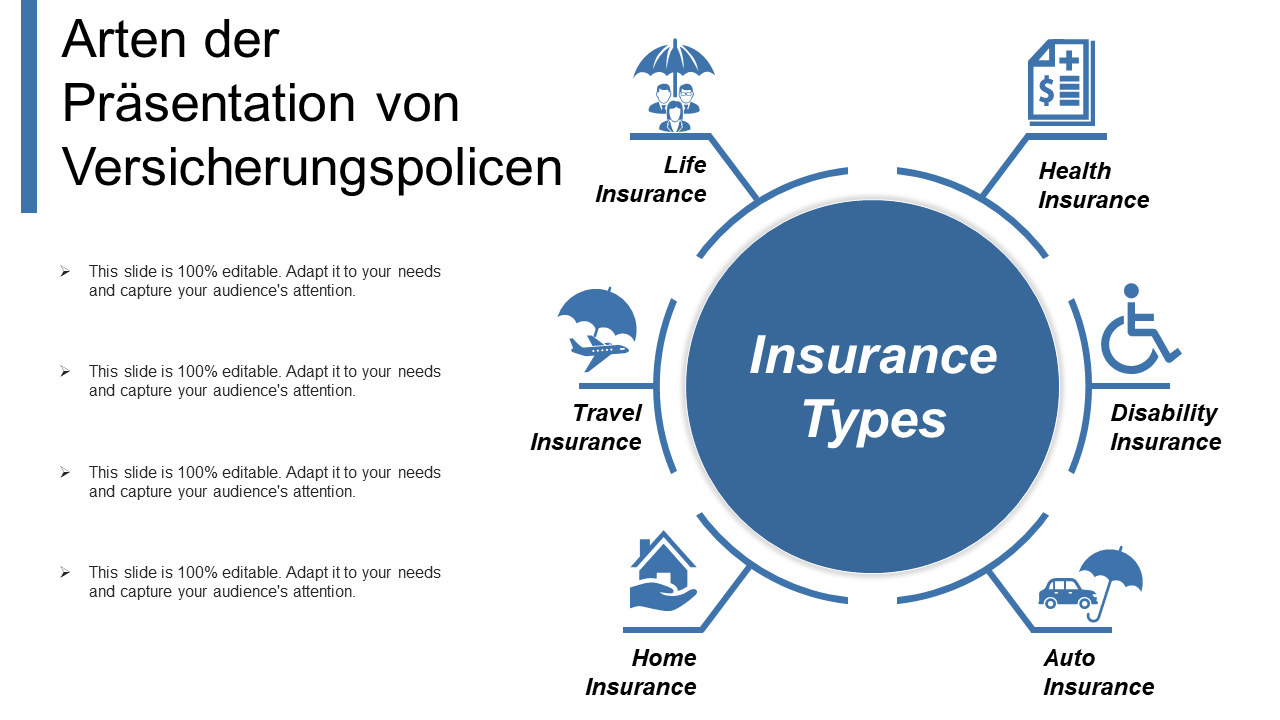

Insurance coverage offers peace of mind versus the unexpected. You can find a plan to cover almost anything, but some are more vital than others. As you map out your future, these 4 types of insurance coverage must be firmly on your radar.Some states also need you to bring accident defense (PIP) and/or uninsured driver protection. These coverages pay for clinical expenditures associated with the incident for you and your guests, regardless of who is at fault. This also helps cover hit-and-run crashes and mishaps with drivers that do not have insurance policy.

However if you don't buy your own, your loan provider can purchase it for you and send you the costs. This might come with a greater expense and with much less protection. Home insurance is an excellent suggestion even if you've paid off your home mortgage. That's since it shields you versus expenditures for residential or commercial property damages.

Insurance Account - Questions

In the occasion of a theft, fire, or calamity, your tenant's plan must cover many of the prices. It may likewise help you pay if you have to remain in other places while your house is being repaired. And also, like house insurance coverage, tenants provides responsibility defense.

Top Guidelines Of Insurance Asia

You Might Want Impairment Insurance Too "In contrast to what many individuals believe, their residence or auto is not their best property. Rather, it is their capability to earn a revenue. Lots of specialists do not guarantee the chance of a special needs," said John Barnes, CFP and proprietor of My Family members Life Insurance Policy, in an email to The Balance.You need to additionally think regarding your demands. Talk with accredited representatives to discover the most effective means to make these plans function for you. Financial organizers can provide recommendations concerning various other typical sorts of insurance coverage that ought to likewise belong to your financial plan.

Health and wellness Insurance policy What does it cover? Wellness insurance policy covers your needed clinical prices, from medical professional's consultations to surgeries. Along with insurance coverage for ailments as well as injuries, health and wellness insurance coverage covers preventative care, such as month-to-month check-ins and also tests. Do you need it? Medical insurance is Visit This Link arguably one of the most important kind of insurance policy.

The Ultimate Guide To Insurance Asia

You possibly do not require it if Every adult must have wellness insurance. There are a number of various types of vehicle insurance coverage that cover various situations, consisting of: Obligation: Responsibility insurance coverage comes in 2 kinds: additional hints physical injury as well as residential or commercial property damage obligation.Accident Protection: This sort of protection will certainly cover medical expenses related to motorist and passenger injuries. Collision: Collision insurance coverage will cover the cost of the damages to your vehicle if you enter into an accident, whether you're at mistake or otherwise. Comprehensive: Whereas accident insurance coverage only covers damages to your cars and truck brought on by click to find out more a mishap, comprehensive insurance covers any car-related damage, whether it's a tree falling on your vehicle or vandalism from unmanageable community youngsters, for example.

There are lots of discounts you might be qualified for to lower your monthly bill, including safe motorist, wed driver, as well as multi-car price cuts. Do you require it? Every state requires you to have auto insurance policy if you're going to drive a lorry.

The 15-Second Trick For Insurance Ads

You possibly don't require it if If you don't have a car or have a driver's permit, you will not require cars and truck insurance. Home Owners or Renters Insurance What does it cover?You might need extra insurance policy to cover all-natural disasters, like flooding, earthquakes, and also wildfires. Tenants insurance policy covers you versus damage or burglary of personal things in a home, as well as sometimes, your vehicle. It likewise covers obligation prices if somebody was harmed in your apartment or if their belongings were damaged or stolen from your house.

Do you require it? Property owners insurance policy is absolutely vital because a home is often one's most valuable possession, as well as is commonly needed by your home loan loan provider. Not just is your house covered, however a lot of your belongings and also individual items are covered, also. Occupants insurance isn't as important, unless you have a big apartment or condo that has lots of belongings.

The Facts About Insurance Agent Job Description Revealed

It's incredibly essential.

Report this wiki page